The invention of money

The invention of money

From Barter to Time-Trading through Bitcoin. The Currency Ideas That Shaped Small Business.

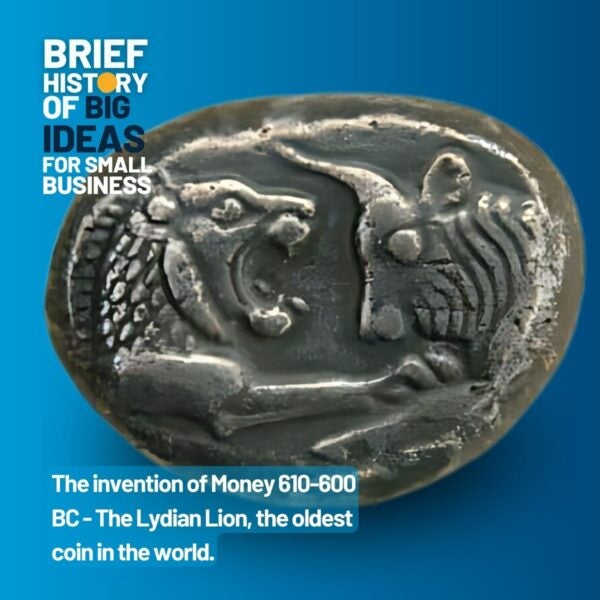

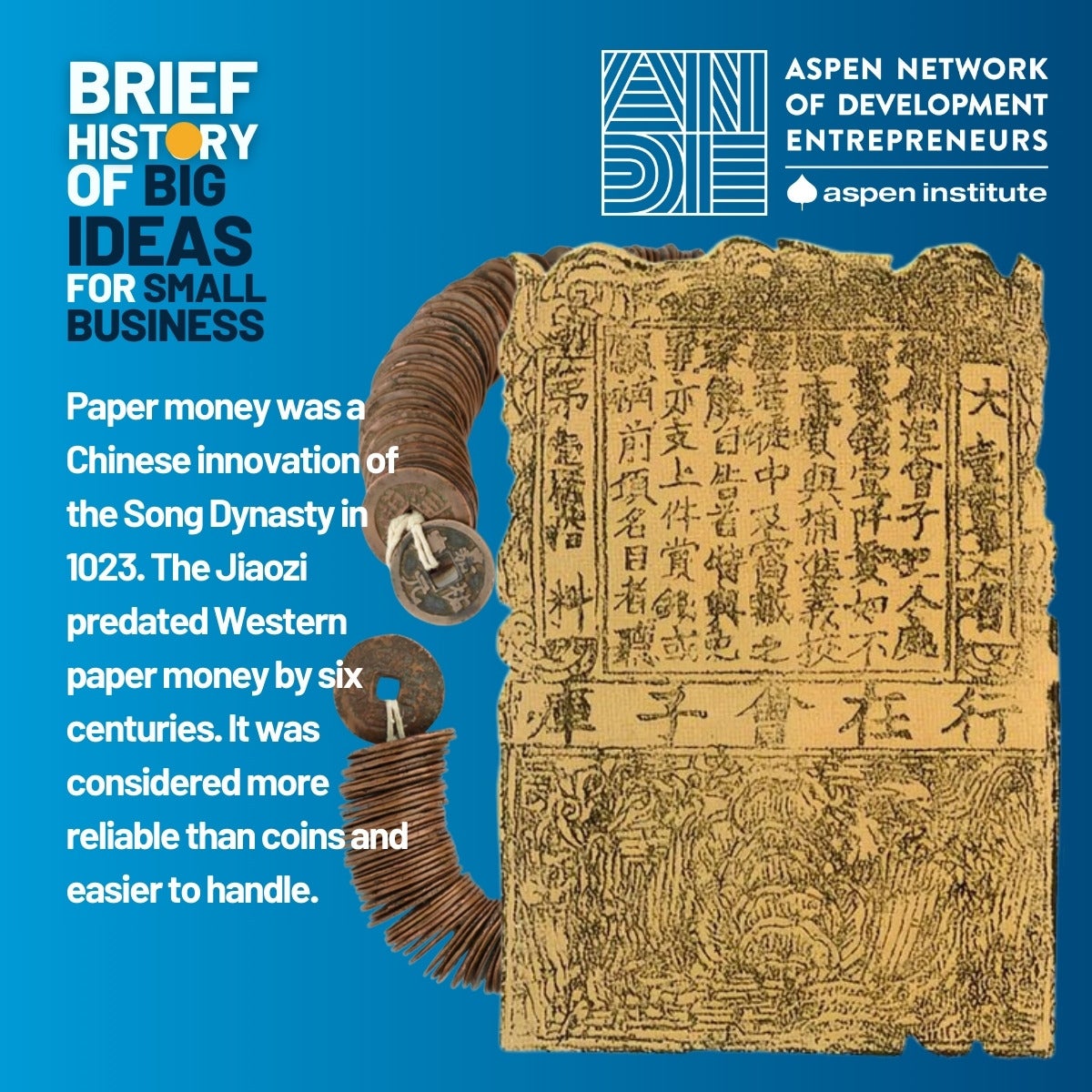

In the sun-baked marketplace of ancient Lydia, Eirenaios the shepherd haggled over the price of a sheep, not with another animal or a bundle of wheat, but with a gleaming silver coin. It was around 600 BC, then a novel transaction and a world-changing innovation. Across the globe, in the Song Dynasty city of Kaifeng (at the time a cosmopolitan capital of more than a million inhabitants), a merchant named Li Wei settled a silk transaction with a crisp sheet of paper money, another revolutionary step in the evolution of commerce.

These seemingly simple acts marked the dawn of a new era in trade, a shift away from the cumbersome barter system that had limited economic growth for centuries. The introduction of money as a medium of exchange was nothing short of a revolution akin to the invention of the wheel or the printing press.

Yet, from its very inception, money has always been a double-edged sword. While it has facilitated trade, fueled innovation, and lifted countless people out of poverty, it has also become a symbol of greed, inequality, and social strife. Philosophers and theologians have long debated its moral implications, with some extolling its virtues as a tool for progress and others condemning it as the root of all evil.

For small business owners like Eirenaios and Li Wei, this meant a world of new possibilities. No longer constrained by the need to find a trading partner with the exact goods they desired, they could now buy and sell with ease, accumulating wealth and expanding their enterprises.

In ancient Lydia, the first coins, stamped with the image of a roaring lion, became a symbol of trust and stability. They facilitated trade not just within the kingdom but across borders, fueling the growth of a vast commercial network that stretched from Greece to Persia. In China, the convenience and portability of paper money revolutionized trade along the Silk Road, enabling merchants to carry vast sums of wealth across vast distances without the burden of heavy metal coins.

The spread of money wasn’t just about convenience; it was about empowering individuals and communities. In medieval Europe, the rise of coinage enabled the growth of towns and cities, as artisans and merchants could now sell their goods and services for a standardized currency, fueling a burgeoning middle class. In the Americas, the introduction of European currencies facilitated trade between colonists and indigenous peoples, though often with devastating consequences for the latter.

The 20th century saw the rise of fiat currencies, backed by the full faith and credit of governments, and the proliferation of credit and debit cards. These innovations further accelerated the growth of small businesses, providing access to capital and expanding consumer purchasing power.

Today, we stand on the brink of another currency revolution as digital currencies like Bitcoin and Ethereum challenge the traditional financial system. But perhaps the most radical transformation lies in the realm of science fiction, where the very concept of money is reimagined.

Imagine a world where time itself is the currency, as in the 2011 science fiction film In Time, by Andrew Niccol with Amanda Seyfried and Justin Timberlake, where individuals trade lifespans for goods and services. Or a society where reputation and social capital, quantified through complex algorithms, determine one’s purchasing power. Perhaps we’ll see a return to bartering, but with a digital twist, where skills and knowledge are traded on global platforms. While the future of money remains uncertain, one thing is clear: the evolution of currency is far from over.

Imagine a world where time itself is the currency, as in the 2011 science fiction film In Time, by Andrew Niccol with Amanda Seyfried and Justin Timberlake, where individuals trade lifespans for goods and services. Or a society where reputation and social capital, quantified through complex algorithms, determine one’s purchasing power. Perhaps we’ll see a return to bartering, but with a digital twist, where skills and knowledge are traded on global platforms. While the future of money remains uncertain, one thing is clear: the evolution of currency is far from over.

The story of money is the story of human ingenuity, of our relentless quest to find better ways to exchange value and build wealth. From barter to Bitcoin, it’s a journey that has transformed societies, empowered individuals, and fueled the engine of economic growth. It’s a story that’s still unfolding, with each new chapter promising to reshape the world of business in ways we can only imagine. But it’s also a story of our complex relationship with wealth, of the tension between prosperity and greed, between economic empowerment and social inequality. The challenge for the future is to harness the power of money for good and create a more just and equitable world where everyone can share in the benefits of economic progress while there is still time.