The KINETIK-ANDE Investment Manager Training (IMT) is the only course of its kind providing a comprehensive overview of investing in small and growing businesses (SGBs). Designed for investment managers actively making investments in SGBs and capacity development providers supporting entrepreneurs, this highly interactive, five-day boot-camp style training draws directly from real investment deals.

Taking place from 30 June to 4 July 2025 in Jakarta, this edition of the Investment Management Training placed special emphasis on climate change, the energy transition, and the vital role of gender equality, disability, and social inclusion (GEDSI) in enabling a just transition.

- Kicking Off with Purpose: Reflections from Day 1 of the KINETIK-ANDE Investment Manager Training

- Assessing the Essentials: Reflections from Day 2 of the KINETIK-ANDE Investment Manager Training

- Entrepreneur Journey: Reflections from Day 3 of the KINETIK-ANDE Investment Manager Training

- Impact Matters: Reflections from Day 4 of the KINETIK-ANDE Investment Manager Training

- Wrapping Up a Transformative Week: Highlights from the Final Day of the KINETIK–ANDE Investment Manager Training

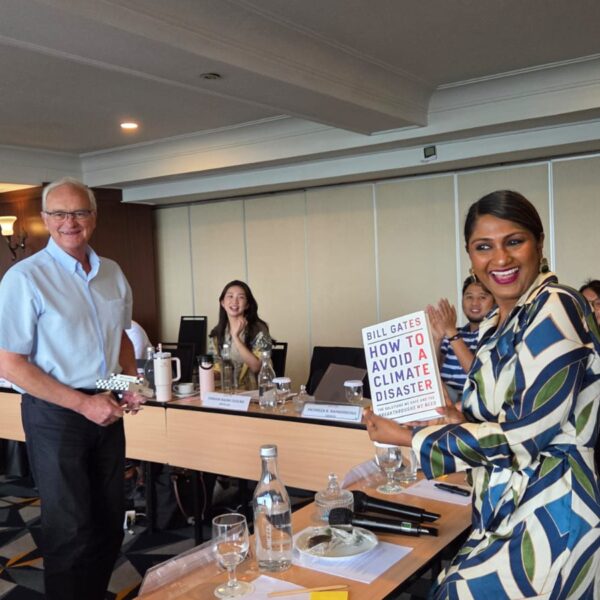

The first day of the KINETIK-ANDE Investment Manager Training set the tone for a thought-provoking and action-oriented week. Led by our experienced facilitator John Kohler, the session opened with an insightful overview of sustainable investment—not just as a financial strategy, but as a purposeful commitment to people and the planet.

One of the most powerful takeaways was the shift from a shareholder to a stakeholder mindset. John emphasized that good investment starts with asking the right questions: What’s the purpose of your investment? Who does it serve? Anchoring investments in a clear “why” encourages long-term thinking and helps align financial decisions with societal outcomes.

Learning by Doing: Case Study Simulations

Participants were split into groups to evaluate real-world scenarios involving small and growing businesses. Each group was tasked with making an investment decision, navigating both quantitative and qualitative data. These exercises prompted dynamic discussions around risk, return, and impact—especially relevant given the cohort’s diverse backgrounds across venture capital, development finance, and impact investing.

From Fund Structures to Deal Screening

John walked us through various fund structures and deal sourcing approaches, and how the investors need to distinguish between what’s essential and what’s merely interesting to make the decision. The group also explored how different funds define investment readiness and impact alignment—drawing lessons from real-life examples.

Introducing Value Chain Investing

A key highlight was the introduction to value chain investing—a strategy that goes beyond backing individual enterprises to strengthening the entire chain of production and distribution. By investing at multiple points in a value chain, investors can help unlock systemic efficiencies, improve resilience, and support inclusive growth.

To wrap up the day, participants applied an impact compass framework to assess a real fund based on criteria like environmental and social governance, scalability, mission alignment, and impact magnitude. The group discussions were rich with debate, showing just how nuanced and multi-dimensional good investment decisions must be.

Day 1 was more than just an introduction—it laid the groundwork for a shared learning journey around purpose and impact. We are excited to see how these ideas evolve throughout the week as participants deepen their skills and perspectives.

Day 2 of the KINETIK–ANDE Investment Manager Training focused on one of the most critical aspects of impact investing: due diligence. We began the day by unpacking the term sheet—its purpose, components, and how it helps investors and entrepreneurs align on expectations and responsibilities.

Our trainer, John Kohler, introduced practical tools to support the assessment process, including the Capability Assessment Matrix (CAM). This tool helps investors objectively evaluate a social enterprise’s current state across key areas such as impact and business model, marketing and sales, operations, management, and financial and legal structures.

We explored how effective due diligence isn’t just about confirming what we think we know—it’s also about uncovering what we don’t know but essential to our investment decision. John also emphasized the importance of recognizing biases during the process. Information may be incomplete or skewed due to cultural, political, or legal contexts. As investors, we need to critically assess the reliability of data sources and understand the local environment in which the enterprise operates.

He then walked us through the key domains of due diligence—covering market, product, finance, management, operations, and legal considerations. These pillars form a comprehensive framework to evaluate the viability and investability of an enterprise, and are essential to any sound investment decision.

To apply the concepts in practice, participants worked in groups on a real-life business case, developing a due diligence plan. This hands-on activity gave everyone a chance to test their understanding and prepare for real-world investment scenarios.

We closed the day with a case study from India’s waste management and circular economy sector, drawn from ANDE’s Access to Green Finance (A2GF) project. The case study illustrated how businesses play a vital role in driving more sustainable solutions in the sector. However, policy and regulatory frameworks remain essential enablers of these efforts, providing the structure and incentives needed to scale and sustain change. The discussion underscored the value of mapping how waste streams are managed through business models—and identifying the landscape of equity investors—lessons that can be applied in Indonesia’s evolving circular economy space.

Day 3 of the KINETIK–ANDE Investment Manager Training brought participants deep into the world of deal structuring and valuation—a critical part of aligning investors and entrepreneurs toward shared growth.

We explored key concepts that influence how deals are shaped, such as liquidity preferences, corporate governance, anti-dilution clauses, and governing law. These tools aren’t just legal jargon—they shape power dynamics, risk, and long-term outcomes.

Participants drew from their own investment experiences and asked thoughtful, challenging questions—sparking vibrant discussions with both the trainer and their investor peers. The energy in the room was palpable.

The highlight of the day? A hands-on term sheet review exercise. In small groups, participants analyzed three real-world term sheets and decided which ones deserved the titles of “The Good,” “The Bad,” and “The Ugly.” This role-play encouraged them to consider the perspectives of both investors and entrepreneurs, building empathy and sharpening their negotiation instincts.

We closed with a discussion on shareholders’ agreements, alternative deal structures, and even a look at how companies are categorized—unicorns, dragons, camels, and zombies—each reflecting different business models and growth journeys.

As part of the KINETIK–ANDE Investment Manager Training, we were thrilled to hear directly from an entrepreneur’s perspective. Amarangga Lubis, Co-Founder and CEO of SolarKita, shared his journey building a rooftop solar business in Indonesia—offering end-to-end solar solutions and launching innovative platforms like KoinKita to engage customers.

He spoke candidly about the challenges of building an impact tech company, especially when it comes to fundraising. He emphasized that investors should look beyond financial metrics to include GHG emissions reduced and other environmental impacts. Amarangga also highlighted a major gap in the ecosystem: there are still not enough quality business development support programs to help entrepreneurs grow and scale their ventures.

A powerful reminder that the right partners, the right support, and the right metrics all matter.

Day 4 of the KINETIK–ANDE Investment Manager Training pushed participants to put theory into practice, marking one of the most technical and hands-on days of the week.

The morning kicked off with a deep dive into structure and valuation, where participants worked in groups using spreadsheets to analyze a real business case. Based on the provided information, each group had to choose a valuation method and develop a structured investment recommendation.

In the afternoon, the focus shifted to impact measurement and management, participants were introduced to international standards including SDG Trackers. To reinforce the learning, participants then engaged in another group activity: analyzing business cases and identifying which impact metrics or SDG targets they would track as fund managers. This exercise not only strengthened their understanding of impact frameworks but also highlighted the real-world challenges of balancing financial performance with measurable, meaningful impact.

From financial modeling in spreadsheets to mapping metrics to global standards, today was all about building the dual skill set that impact investment managers need: technical competence and strategic thinking.

This afternoon, we were joined by Brianna Losoya-Evora, Head of Impact Measurement & Management and Strategic Partnership at Sweef Capital, who shared how their team integrates impact deeply into investment practice—with a strong focus on gender equity and the Asia-Pacific region.

Brianna walked us through Sweef’s approach, including their Theory of Change, impact risk framework, and the Gender ROI™, using real-life portfolio examples to bring the concepts to life. She emphasized how investors can drive real impact—not just by investing, but by signaling that impact matters, engaging actively, and providing flexible capital.

We also explored the climate–gender nexus, and how empowering women is key to building sustainable, climate-resilient solutions.

This session was a powerful showcase of how a GEDSI and climate lens can be embedded in investing—a core focus of this edition of the Investment Manager Training.

The final day of the KINETIK–ANDE Investment Manager Training (IMT) was a fitting close to an energizing and thought-provoking week. We kicked off with a deep dive into blended finance—examining its current trends and the evolving state of the sector. The conversation seamlessly connected to one of the core themes of this IMT edition: gender equality and energy transition, with a spotlight on Women in Energy. Participants explored real-world blended finance facilities both within Southeast Asia and globally that are helping address gender and energy access challenges.

Building on this momentum, the group turned their focus to catalyst fund structures—a topic that sparked active discussion and idea-sharing. It was clear that many participants are already thinking ahead about how to mobilize capital more strategically and build a more inclusive and sustainable impact investment ecosystem in their home markets.

Next, John Kohler guided the group through the essentials of portfolio performance monitoring. A hands-on group discussion followed, where participants evaluated an investment scenario and debated whether to make a follow-on investment, and under what terms. This exercise brought together many of the key learnings from throughout the week, reinforcing how theory translates into practice.

Toward the end of the day, participants had the opportunity to work on their own action plans—a chance to reflect on the tools and insights gained during the training and outline practical next steps for advancing their work in the impact investing space.

In the final session, the training explored how investors can add post-investment value through capacity building and strategic support for small and growing businesses (SGBs). John shared good practices for portfolio performance management and flagged some common pitfalls to avoid.

After the award ceremony, we wrapped up the week with a relaxed farewell dinner—a welcome wind-down from the intensive week of learning. It was also a valuable moment to strengthen relationships and networks among fellow participants, many of whom are already exploring future collaborations.

Congratulations to all the participants! Your commitment, insights, and energy throughout the week have been truly inspiring. Now it’s time to take what you’ve learned and put it into action—unlocking more capital and driving greater impact in your ecosystems.

Stay tuned for the next edition of the ANDE Investment Manager Training!