According to the new “Sustainable Signals” report by the Morgan Stanley Institute for Sustainable Investing, individual investor interest in sustainability is on the rise.

According to the new “Sustainable Signals” report by the Morgan Stanley Institute for Sustainable Investing, individual investor interest in sustainability is on the rise.

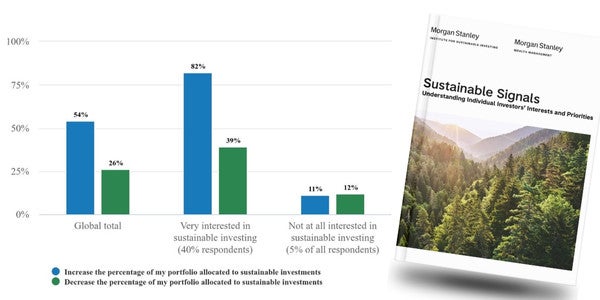

More than three-quarters (77%) of investors globally express interest in investments that target market-rate returns while also considering positive social and/or environmental impact. Over half (57%) of investors report increased interest in the past two years, and 54% plan to increase their sustainable investments in the coming year.

Morgan Stanley Institute for Sustainable Investing’s latest report, “Sustainable Signals,” offers valuable insights into the evolving landscape of corporate sustainability.

The following are its more important conclusions.

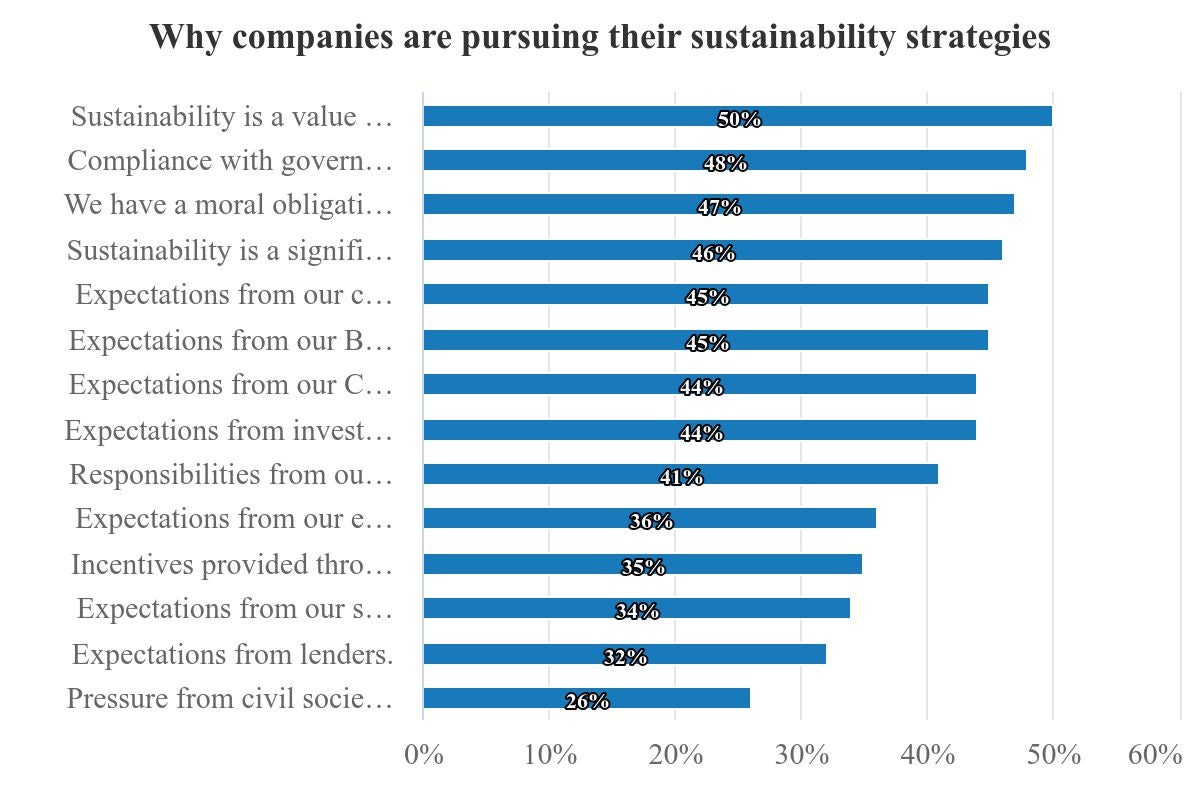

- Value creation as the driving force: Companies increasingly recognize sustainability as a value creation opportunity, not merely a risk management strategy. This marks a significant shift in corporate thinking, where sustainability is becoming integral to long-term business objectives.

- Investment challenges: While the value proposition is clear, the high level of investment required to implement sustainability strategies remains a major hurdle. Access to capital and innovative financing mechanisms, such as green bonds, are crucial for companies to achieve their sustainability goals.

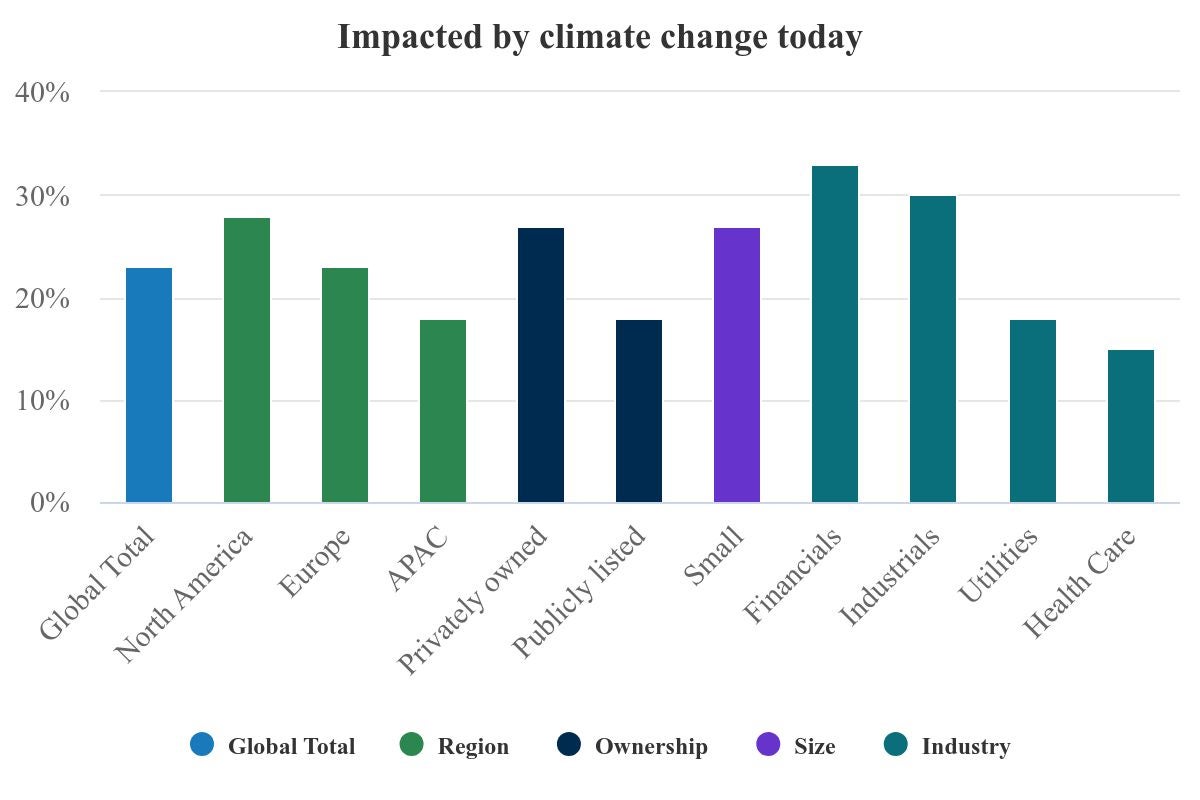

- Climate change as a business risk: Climate change is no longer a distant threat. Companies are experiencing its impact on their business models today, alongside traditional risks like supply chain disruptions and geopolitical conflicts.

- Sustainability in decision-making: Sustainability is permeating all levels of corporate decision-making, from boardrooms to capital expenditures. However, there’s a need for greater expertise among directors to navigate complex issues like sustainability regulations and financing instruments.

A Shift in Corporate Priorities

This report is a must-read for anyone interested in the intersection of business and sustainability. It offers a comprehensive look at the current state of corporate sustainability, highlighting both the opportunities and challenges.

The findings are particularly relevant for small and growing businesses (SGBs) ecosystem stakeholders looking to integrate sustainability into business models and promote access to capital for sustainable growth.

The report also underscores the importance of collaboration between the private sector, investors, and policymakers to create an enabling environment for sustainable business practices. It calls for innovative financing solutions and greater knowledge sharing to overcome the barriers to sustainability implementation.

“Sustainable Signals” paints an optimistic picture of a future where sustainability is not just a buzzword but a core business principle. It’s a future where businesses can thrive while contributing to a more sustainable and equitable world.