Small and growing businesses (SGBs) power local economies, but many remain hard for lenders and investors to evaluate. Even when a business is performing well, limited documentation can make it difficult to demonstrate cash flow, track risk, or qualify for growth capital.

On December 9, 2025, ANDE hosted ONOW for a member learning session on how its DayTwo app helps entrepreneurs create consistent transaction records without requiring formal accounting systems.

The invisibility problem

Matthew Wallace, ONOW’s co-founder, opened with a challenge that resonates across markets: when lenders can’t verify performance, capital often concentrates among businesses that already have visible histories. Many entrepreneurs operate with paper notebooks, informal receipts, or memory-systems that may work day to day but don’t translate into documentation a financial institution can underwrite.

The result is a familiar cycle: limited records make risk harder to assess; harder-to-assess risk raises the cost of capital (or closes access entirely); and businesses that could grow end up relying on costly, short-term lending or staying smaller than their demand would support.

As Matt put it: “Capital flows to the top while businesses at the bottom remain invisible.”

A farmer’s financial reality

To make the issue concrete, Nathan Temeyerm, chief product officer and co-founder of ONOW Ascent Inc., introduced participants to Somjai, a small farmer in Chiang Mai, Thailand. Nathan stepped into the role of her “accountant” and led the group through a practical exercise: recording a dozen daily transactions, including crop sales, supply purchases, household spending, and credit sales.

The prompt was simple: calculate Somjai’s daily profit. But the group quickly ran into the questions real entrepreneurs face every day:

- Which expenses are business costs versus household spending?

- How do you record credit sales that won’t be paid today?

- What about money borrowed from family or repaid in-kind?

- How do you capture small transactions that happen frequently and informally?

The takeaway wasn’t that small business owners lack capability. It’s that many accounting systems assume time, training, and consistency that entrepreneurs rarely have, especially when the goal is simply to answer a practical question: Did I make money today?

What DayTwo does differently

DayTwo is designed as a bridge between paper notebooks and full-featured accounting software. It enables users to record transactions quickly, categorize entries (including business vs. personal), and track credit arrangements with customers, creating a running, structured history over time.

To reduce manual entry, the app can digitize receipts and invoices using computer vision and optical character recognition (OCR). ONOW shared that this approach can make daily record keeping easier for entrepreneurs who are already managing multiple responsibilities and may not have formal bookkeeping training.

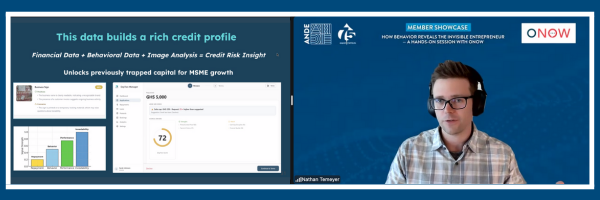

From records to risk assessment

DayTwo’s value is not only convenience. It is what consistent records make possible.

Over time, a structured transaction history can support clearer views of cash flow, seasonality, and operating patterns. With the entrepreneur’s consent, records can also be shared in formats that lenders and investors can review, helping them move from assumptions to evidence when assessing risk.

In other words: documentation turns “invisible” enterprises into documentable ones.

Why it matters for ESOs, lenders, and investors

When financial institutions can assess risk more accurately, they can design better products and reduce friction in the process, whether through faster decisions, more appropriate terms, or more realistic documentation requirements. For entrepreneurs, consistent records can help with internal management (pricing, purchasing, repayment planning) as well as external credibility.

For enterprise support organizations (ESOs), tools like DayTwo present a practical complement to training. Rather than asking every entrepreneur to master formal accounting, ESOs can help clients adopt lightweight systems that naturally produce the records lenders require, building financial visibility as a byproduct of day-to-day operations.

The challenge of “invisibility” is often less about performance than proof. When we solve for documentation, we expand who can be evaluated, and therefore who can be financed.

- For enterprise support organizations: Consider fintech tools that reduce the burden of record keeping while generating lender-readable histories. ONOW is seeking ESOs interested in participating in pilot programs.

- For lenders and investors: Explore how shorter, but consistent, digital transaction histories can inform underwriting, especially when paired with sector or seasonal context.

- For small business owners: Start capturing transactions consistently. Even simple, daily records can become an asset that supports better decisions and stronger access to capital.

Interested in learning more about DayTwo pilots? Reach out to Joy Munthamraksa at joy.munthamraksa@aspeninstitute.org.