Access to Green Finance Project

Investment Innovation Fund

The call for proposals in India is now open. ANDE expects to announce subgrant winners by mid June 2025.

Request for Proposals - India

Open Date: 5 April 2025

Proposals Due: 7 May 2025

Awards Announced: Mid June 2025

Duration: Up to 18 months

Funding: Up to US $100,000

Overview

-

ANDE is seeking proposals for its round two launched Investment Innovation Fund, which aims to empower selected entrepreneurship support organizations (ESOs) to develop supplementary programs or interventions in collaboration with investors.

-

These initiatives are anticipated to enhance capital deployment in waste and circularity businesses.

-

The proposed projects will pilot, test, or expand scalable solutions to support Waste and Circularity in Small and Growing Businesses (SGBs) in India, generating valuable insights for the wider SGB sector.

ANDE India Investment Innovation Fund Office Hours

Are you considering applying for Round Two of the ANDE Investment Innovation Fund? Do you have questions about eligibility, project scope, or the application process? Our Office Hours provided the guidance you needed.

About ANDE

The Aspen Network of Development Entrepreneurs (ANDE) is a global network of organizations that propel entrepreneurship in developing economies. ANDE members support “the missing middle”—the small and growing businesses that are the engines of growth in developing economies and have the potential to address critical social and environmental challenges.

Members include both for and nonprofit investment funds, capacity development providers, research institutions, development finance institutions, foundations, and corporations from around the world.

Our partnership with the IKEA Foundation

In partnership with the IKEA Foundation, ANDE set out in 2021 to understand and bolster support for green entrepreneurial ecosystems in India and Kenya, which is key to helping both countries adapt to the effects of climate change. The project culminated in detailed research reports outlining the opportunities and challenges in each country.

The primary challenge cited by entrepreneurs and intermediaries was access to finance, driven by a limited number of local investors interested in green enterprises, a lack of clarity regarding the business models and potential return on investment, and a tendency for investors to prefer tech-oriented solutions that are quick to scale.

ANDE and the IKEA Foundation are now undertaking a second phase to work toward closing these gaps in access to finance, focusing specifically on the waste management and circularity sectors.

The 2024 Investment Innovation Fund

ANDE has run Catalyst and Challenge Funds since 2009 with the purpose of fueling initiatives poised to improve the capacity of organizations within the small and growing business (SGB) sector.

These funds have taken many forms and addressed various sector challenges since then, but their core function remains constant – the fund awards SGB support service providers with the risk-tolerant capital they need to test or pilot innovative approaches to SGB sector challenges and distribute learnings within the ANDE community and SGB sector at large.

The 2024 Investment Innovation Fund awarded $300,000 to two Indian organizations to accelerate capital flow to waste and circularity businesses, fostering a thriving green entrepreneurial ecosystem.

Guidelines

The Investment Innovation Fund will enable selected entrepreneurship support organizations (ESOs) to design supplemental programs or other interventions in consultation with investors that are likely to lead to more capital deployed in waste and circularity businesses.

These proposals should pilot, test, or expand scalable solutions that support waste and circularity SGBs in India to create learnings and insights for uptake by the broader SGB sector.

ANDE is specifically seeking submissions employing creative capacity building solutions that increase the chances of the portfolio attracting private capital to help them grow and scale in at least one of the following categories:

-

Transformative approaches to delivering incubation or acceleration services including recruitment, selection, cohort and program design or other elements seen as constraints to the investability in Waste and circular economy SGBs.

-

Supplemental services delivered independently or in coordination with traditional incubator or accelerator programs including tailored consulting services, bespoke matchmaking, investment facilitation, mentorship or other approaches to address investment deficits in traditional acceleration.

-

Novel approaches to addressing systemic constraints that result in less investment being received by waste and circularity enterprises. For example, an incubation or acceleration program targeting waste management and circularity enterprises designed in partnership with potential follow-on investor/s that improve chances of follow-on investment.

These activities should also, when possible, build the capacity of implementing organizations to continue to expand access to financing for waste and circularity in the future. Submissions should be for activities of up to 18 months with a maximum total request of US $100,000. Note that proposal budgets will be evaluated for efficient use of funds.

Problem Statement

As identified through ANDE’s research and “Action Labs” in Phase 1 of the Access to Green Finance project, there is significant green entrepreneurial activity in place in India, but there is one key sector with both significant opportunity for greater investment and a limited number of existing actors taking up those challenges: Waste Management and Circular Economy, with sector market size estimated to US $823.2 billion in India. Ecosystem snapshot data from India reveals that most support organizations in the green enterprise ecosystem make their financial support available to ventures that have proven profitability, leaving gaps in support for ventures in their earlier stages of development.

The sector deep dives in the full research report also reveal that the Waste Management and Circular Economy sector is dominated by informal businesses that are not adequately supported or engaged by the government.

Activities in Phase II will therefore focus specifically on strengthening the entrepreneurial ecosystem within the sectors of Waste Management & Circular Economy in India in order to increase the availability of early stage capital to SGBs, expand the intermediary support that prepares ventures for investment, close knowledge gaps, and facilitate policy conversations to more productively engage the large informal waste sector to formalize and scale.

It is clear that present acceleration services, as commonly delivered, are not sufficient to scale waste and circularity businesses. This is also true on a global scale, with research from the Global Accelerator Learning Initiative (GALI) showing that inefficiencies in the accelerator-to-investment pipeline are leaving many entrepreneurs unable to reach the next stage of business growth.

ANDE, with funding from the IKEA Foundation, invites proposals that address this financing gap by testing models that catalyze investment into the sector through innovative approaches that improve collaboration between investors and ESOs to improve financing outcomes. The Investment Innovation Fund will source, test, and promote creative and impactful solutions to address this investment issue in India.

Applicant Criteria

Incubators, accelerators, capacity development providers, entrepreneur support organizations, and research and advisory service providers are welcome to apply. Preference will be given to proposals submitted by consortiums consisting of ESOs and investors.

Note that donor agencies, foundations, and corporations are not qualified to apply. Also, when investor-ESO consortiums apply, funding will only go to ESOs. The number of proposals supported will be contingent on the quality and impact of the proposals received.

Organizations may form a consortium and submit a joint proposal. An organization may submit or be involved in up to two proposals, however only one proposal will be selected. Only proposals submitted in English will be considered.

Geography

Please Note: Funding will be directed to ESOs from the US, so all necessary government approvals (FCRA, etc.) need to be in place for application.

Only SGB ESOs with programs in India will be considered. Programs taking place outside of India will not be considered.

Application Timeline and Process

-

5th April 2025 • RFP Released

-

23rd April, 2025 • Office hours to answer questions

-

May 7th, 2025 • Submission deadline

-

Mid June 2025 • Winners notified

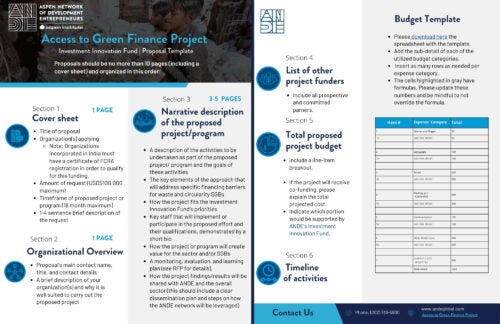

Proposal Structure

To apply for an Investment Innovation Fund grant, please provide a brief proposal (no more than 10 pages, including a cover sheet) that clearly follows this template.

Monitoring, Evaluation, and Learning (MEL)

A key objective of the Innovation Fund is to rigorously test models and disseminate learnings on the most effective and efficient ways to catalyze investment into waste and circularity SGBs.

To ensure that the insights that emerge from these projects can inform other stakeholders, each proposal should describe how they will:

-

Embed impact measurement as a core component of the project (ensuring it provides meaningful and value-adding insights that further strengthen their model and subsequently inform other organizations’ models as well).

-

Identify common themes/learnings regarding what worked, what didn’t, and why.

Successful proposals will involve the following

-

A clearly articulated theory of change (in narrative or graphical form) that outlines how the approach represents a solution to the constraints and barriers to investment capital for waste and circularity businesses.

-

A MEL plan including illustrative core quantitative and qualitative outcomes and indicators, data collection methods (including timelines and approaches) and intended mechanisms for determining the level of contribution of activities to observed changes.

-

To ensure that the Investment Innovation Fund leverages comparative learnings from across different projects, ANDE will work with organizations selected to receive funding from the Innovation Fund to finalize MEL plans to ensure they include some standardized indicators.

Those standard indicators are as follows:

-

Revenue data from supported SGBss in the prior calendar year and following the grant period;

-

Amount and type of investment capital raised by supported SGBs in the prior calendar year and following the grant period.

Evaluation Criteria

Clarity

-

-

-

Is there a clear understanding of the problem this fund seeks to address?

-

Is there a well-defined roadmap for how the proposed intervention would improve investability of waste and circularity SGBs – what is the innovation involved?

-

Are solution objectives as well as justification of the proposed solution clearly articulated?

Feasibility and Internal Capacity

-

How is the feasibility articulated for the objectives and roadmap?

-

Is the timing, sequencing, and resourcing of the effort reasonable?

-

Has the organization demonstrated its ability to achieve the milestones laid out in the proposal?

-

Has appropriate staffing been articulated both for qualifications and size?

-

Has the organization demonstrated sufficient internal capacity and expertise to manage the implementation?

-

Are the funds provided being leveraged (through partnerships, matching funds, etc.) to ensure maximum impact?

Impact

-

Does the proposed model clearly address a barrier to the financing gap for waste and circularity SGBs in India?

-

Does the proposal present a credible rationale for why this model is likely to be successful in bettering/ensuring increased investment into waste management and circularity SGBs in India?

-

Does the proposal present a clear articulation of the intended impact on the Innovation Fund’s objectives in the 18-month project period as well as for the potential sustainability and scalability of the model going forward?

Monitoring, Evaluation, and Learning

-

Is a theory of change clearly articulated?

-

Has a monitoring, evaluation, and learning plan been devised and does it communicate how measurement and learning will be integrated throughout the proposed activities?

-

Is there a clear plan to disseminate learning?

-

To what extent will lessons from this project inform the work of SGB service providers and investors?

-

-

-

-

Submissions

Please send completed proposals by emailing Ananya Saini at Ananya.Saini @ aspeninstitute.org no later than 11:59 pm IST on May 7, 2025.

For questions, sign up and attend our virtual office hours on April 23, 2025.