Primera Estimación del Tamaño del Mercado de Inversión de Impacto en México

Un proyecto colaborativo de ANDE, GIZ México y AIIMx

México ha carecido históricamente de datos sistemáticos sobre su mercado de inversión de impacto, limitando la toma de decisiones estratégicas y el diseño de políticas efectivas públicas. Este estudio llena ese vacío crítico al presentar la primera estimación cuantitativa rigurosa del sector.

El informe analiza 11 dimensiones fundamentales: conceptualización de la inversión de impacto, dimensionamiento del mercado, caracterización de actores, fuentes de financiamiento, comparativo regional con Brasil, Colombia, España y Centroamérica, distribución sectorial y geográfica, etapas de desarrollo empresarial, prácticas de medición de impacto, expectativas financieras y retos estructurales del sector.

Entre los hallazgos destacan: el 72.3% de los inversionistas prefiere la colocación directa de capital; los fondos de inversión concentran el 59,3% de la actividad; y agricultura, salud y economía circular emergen como sectores prioritarios. También identificamos brechas significativas en vivienda asequible y economía del cuidado como oportunidades estratégicas.

¿Para quién es útil?

- Inversionistas que buscan oportunidades alineadas con impacto

- Emprendedores que requieren capital paciente

- Gobiernos diseñando políticas públicas e incentivos fiscales

- Organismos multilaterales canalizando recursos técnicos y financieros

- Organizaciones del ecosistema identificando brechas de mercado

India’s waste management sector is at a critical inflection point. Rapid urbanisation, evolving consumption patterns, and rising waste volumes have outpaced the capacity of existing systems. While regulatory frameworks have matured, implementation remains fragmented. Only 54% of waste is processed; the rest is either informally recovered or dumped in over 3,100+ dumpsites across the country.

The SAAF Cities initiative was launched to explore the feasibility of a platform-based approach to scaling innovations in urban waste management. This study drew on primary engagement and secondary research with 32 stakeholders—including Municipal corporations/Urban Local Bodies (ULBs), startups, corporates,

and ecosystem enablers, alongside a review of over 700 startups (small and medium enterprises) and 100+ innovation applications.

Jointly anchored by Villgro and the Socratus Foundation, with support from HDFC Bank, the report aims to identify systemic gaps and key priority areas for innovation, focusing on financing, regulatory challenges, and mechanisms to operationalize solutions and models at scale, to advance circularity principles and enhance

material recovery in waste management.

At Common Good Marketplace, we believe that markets can, and must, be redesigned to serve the common good. This report affirms that belief and was a unique opportunity for us to research an area of corporate activity that holds significant promise to accelerate human flourishing alongside more equitable and resilient practices: social procurement.

As global priorities shift in response to economic, environmental, and social pressures, the role of corporate procurement is evolving. What once focused narrowly on cost and efficiency is now expanding to embrace accountability, inclusion, and impact. Social procurement represents a transformational opportunity to realign purchasing power with purpose, and to do so in ways that are not only ethical, but strategic, scalable, and measurable.

This report, developed in partnership with SAP and informed by insights from ecosystem leaders from around the world, highlights the critical importance of unlocking the full potential of social procurement. By embedding measurable and verifiable results into procurement structures, we can move from intention to accountability, and from outputs to definable results.

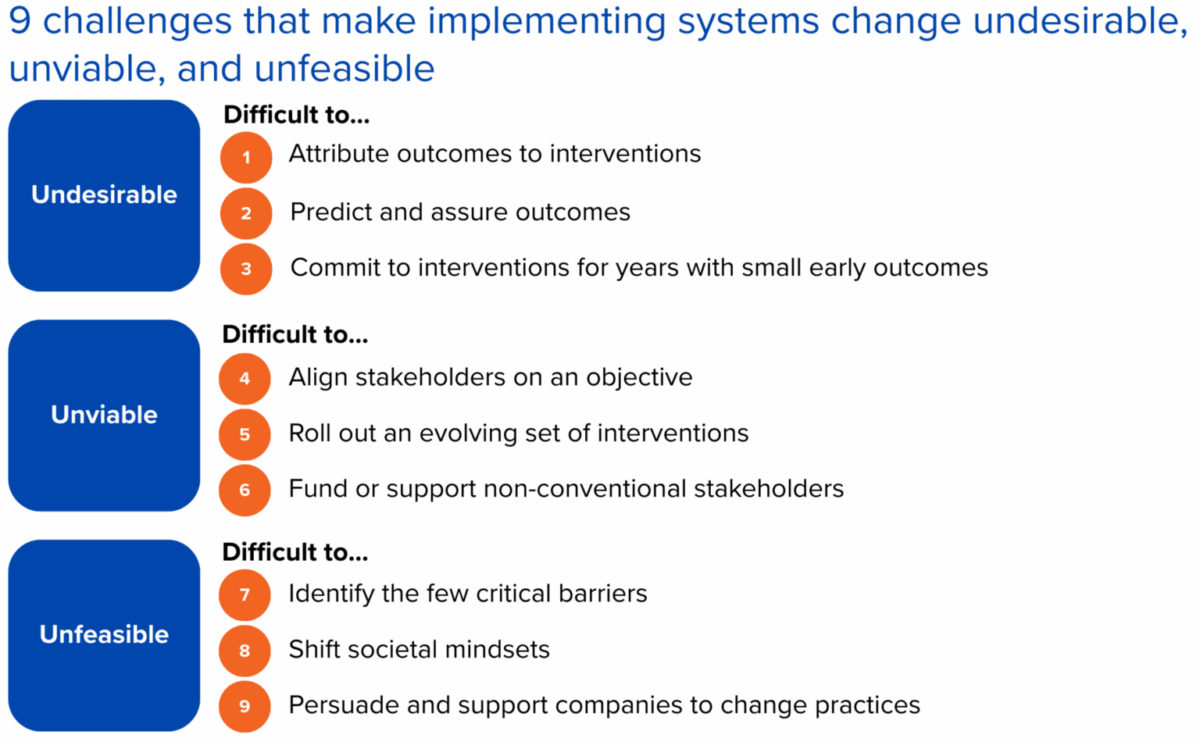

While enthusiasm for systems change has grown steadily over the past decade, we find a significant gap persists between this enthusiasm and execution. Funders attempting to implement systems change consistently face 9 challenges, including unclear outcome attribution, long commitment horizons, and complex stakeholder coordination.

When faced with these challenges, it is understandable why many funders find themselves defaulting to patching the system rather than changing it. The pressures are real: boards expect clear metrics, program timelines demand quick wins, and established processes reward predictable outcomes. These institutional realities often nudge funders toward incremental fixes, even when they recognize deeper change is needed.

This report names and explores the challenges in implementing systems change and provides steps to navigate them. We draw on the authors’ 14 years of experience implementing systems change programs in the Global South across affordable housing, early childhood education, and gender equity. Foundation leaders (e.g., CEOs, principals, and other executives) can use this guide to implement systems change in their work, finding entry points that align with their foundation’s current capacity, constraints, and strategic objectives.

Funders can choose to lean in and make their intent to change the system explicit. Doing so would offer the potential for permanent, transformative change that continues long after the intervention or program ends. This choice requires abandoning the comfort of clear attribution and predictable outcomes and accepting that it may be impossible to claim credit for your contributions. The communities you serve rarely need you to prove exactly which intervention created change, but they do need you to commit to changing the conditions that trap them in cycles of inequity.

“Courage is not the absence of fear, but action in spite of it.” – Nelson Mandela

Reimagining gender lens investing futures is both a reflection on the field today and a hopeful vision for where it could go, grounded in the real work of field builders across geographies and sectors. These practitioners continue to defend gender’s continued relevance to finance in the face of resistance. They are also expanding its role, reimagining its potential as a tool for change, and building the infrastructure needed to sustain that change over the next decade.

Criterion Institute has long defined field-building as the weaving together of ideas, people, and activities in ways that enable systems change. In this moment, the field of gender lens investing must act to both celebrate and support risk-takers. It must also bring to light overlooked wisdom and hold the space for multiple definitions of what ‘good’ looks like.

This report comes ten years after the first Criterion State of the field of gender lens investing report. In 2015, the field’s broad aim was to prove that gender mattered in investing. Today, field builders are asking bolder questions: How do we shift power? What does it look like to invest in healing, not just scaling the field? Which systems should be redesigned?

It is a snapshot of ambition rather than a map of all activity. It makes visible ideas, organizations and activities that don’t always attract headlines or capital. It invites funders to expand what they see as “fundable.” And it offers a broader story of what gender lens investing could be when defined by those closest to the work.

Max Simpson, Founder and CEO of Steps (Thailand), opened with a powerful reframe: disability or neurodivergence isn’t a personal limitation—it’s a societal barrier. His B Corp-certified organization proved that simple accommodations create an outsized impact. “Society creates disability,” Max emphasized, sharing how 71% of workplace accommodations cost $500 or less, with 20% costing nothing at all.

Max Simpson, Founder and CEO of Steps (Thailand), opened with a powerful reframe: disability or neurodivergence isn’t a personal limitation—it’s a societal barrier. His B Corp-certified organization proved that simple accommodations create an outsized impact. “Society creates disability,” Max emphasized, sharing how 71% of workplace accommodations cost $500 or less, with 20% costing nothing at all.

Steps’ practical solutions are elegantly simple: zone spaces by activity, provide multiple seating and lighting options, organize and label everything, and create accommodation stations that destigmatize accessibility tools. Their job-sharing approach breaks complex roles into component skills, allowing neurodivergent employees to excel in their strengths rather than struggle with mismatched requirements.

Vinaya Chinnappa, CEO of Incluzza India, tackled the budget myth head-on. Traditional top-down budgeting perpetuates exclusion, while inclusive budgeting turns financial plans into equity tools. Her approach centers on three principles: participation, transparency, and equity.

“Accessibility is expensive” is the biggest myth blocking progress, Vinaya argued. Building inclusion into initial design costs far less than retrofitting, and the hidden costs of doing nothing – lawsuits, lost talent, damaged reputation – continue mounting. Simple changes like adding alt-text to presentations take minutes but create immediate access.

Rashi Maharjan from Impact Hub Kathmandu shared raw, honest lessons from two programs that didn’t go perfectly, and that’s exactly what made them valuable. During their Nepal Assistive Device Makeathon, venue accessibility challenges became teachable moments. “Accessibility is not an afterthought—it’s a foundation for respect,” Rashi stressed.

Rashi Maharjan from Impact Hub Kathmandu shared raw, honest lessons from two programs that didn’t go perfectly, and that’s exactly what made them valuable. During their Nepal Assistive Device Makeathon, venue accessibility challenges became teachable moments. “Accessibility is not an afterthought—it’s a foundation for respect,” Rashi stressed.

Her Building Entrepreneurial Access Model (BEAM) program revealed deeper truths: entrepreneurship often becomes a last resort for people with disabilities facing workplace discrimination, yet their innovations frequently emerge from necessity and resourcefulness. Key insight is co-creation with persons with disabilities from day one, not consultation at the end.

This report provides an overview of the 2025 Inaugural Pan Africa Conference, hosted by the Aspen Network of Development Entrepreneurs (ANDE), held in Dakar, Senegal, from February 11–13. The conference brought together stakeholders from across the continent to explore collaborative solutions to Africa’s most pressing development challenges. Central themes included collective action, the future of work and youth engagement, Pan-African collaboration, the power of storytelling for impact, and the role of creative entrepreneurship in sustainable development.

The report is structured into four sections, each highlighting a core component of the conference: plenary sessions, breakout sessions, workshops, and roundtables. Together, these sections capture the diverse insights, discussions, and outcomes that emerged throughout the event.

Women leaders have shown promise in improving business performance. A survey by the International Labour Organisation (ILO) in 2019 – covering shopkeeping, sales or trade activities, manufacturing, construction, education, financial/insurance activities, and other economic services – observed that when enterprises have a gender-inclusive business culture and policies, they experienced 63 per cent increase in business productivity and profitability. Additionally, 60 per cent enhancement in the ability to attract and retain talent and a 59 per cent improvement in creativity, innovation and openness (ILO 2019).

Furthermore, globally, funders and investors are increasingly attracted to ethical and gender-inclusive funding, recognising its dual benefits to business and society. With a gender-smart approach, you can seize the opportunity to access the pool of funding by showcasing its tangible impact on gender-related outcomes, effectively aligning its initiatives with the evolving priorities of the investment landscape. Thus, by breaking down gender barriers, you can access diverse skills and expertise, strengthening your workforce and overall competitiveness.