ANDE and the IKEA Foundation launched the second phase of a partnership to improve access to finance for waste and circularity enterprises in India and Kenya.

As part of this initiative, ANDE aims to unify forward-thinking investors dedicated to seeding early-stage ventures in waste management and the circular economy. The project will support investors interested in waste and circularity through a series of activities to improve their knowledge, networks, and strategies around investing in the sector.

The cohort seeks to assemble organizations keen on deepening their market insights and readiness to channel investments into nascent waste and circularity enterprises within Kenya and India.

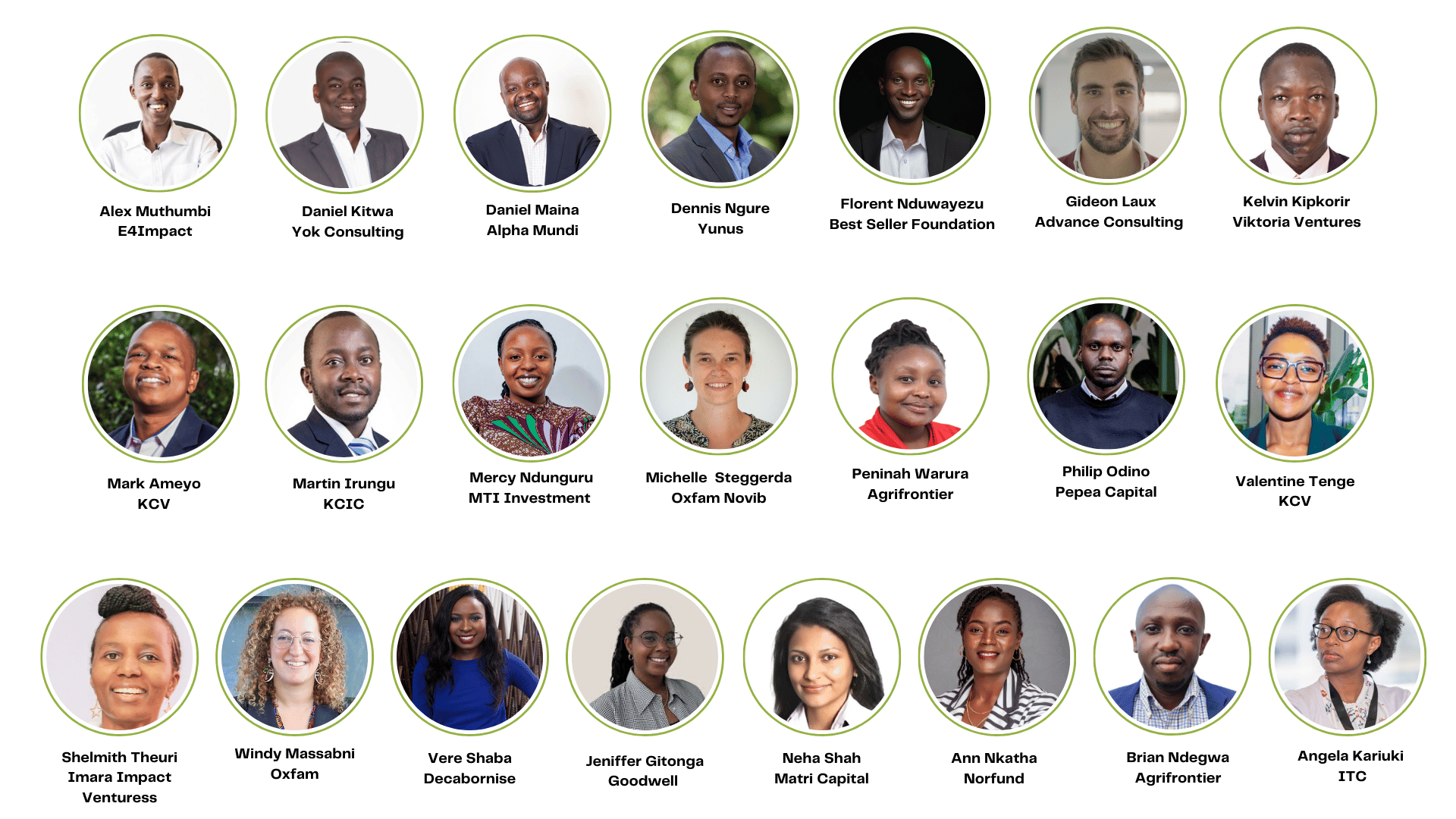

The members selected for this cohort are investors who either have a track record in these sectors or are exploring opportunities to contribute to environmental sustainability. A particular emphasis was placed on locally-based investors, fostering a community deeply rooted in the regions it serves.

Meet the Kenya Cohort

What’s next

Participants will engage in a curated suite of activities designed to enhance their understanding of waste and circularity business models, equip them with the tools to measure the impact of various waste management business models, and connect them to ecosystem actors who might provide a pipeline of investable businesses.

Key Features of the Program

Investment Manager Training

Cohort members will benefit from a bespoke version of ANDE’s Investment Manager Training (IMT), tailored specifically to the nuances of waste and circularity, scheduled for 2024 and 2025 in India and Kenya.

Sector Investment Guides

ANDE is working with experts to produce detailed guides on investing in the waste and circularity sectors in India and Kenya, poised to serve as the go-to resource for cohort members and the wider public.

-

- Investing in the Waste & Circular Economy Sector in India: An Introductory Guide

- Investing in the Waste & Circular Economy Sector in Kenya: An Introductory Guide

- Investing in the Waste & Circular Economy Sector in India: A Deep Dive Guide

- Investing in the Waste & Circular Economy Sector in Kenya: A Deep Dive Guide

Investor – ESO Workshops

A series of collaborative workshops will provide a platform for investors and entrepreneur support organizations (ESOs) to refine investment strategies, share insights, and brainstorm on how to improve the pipeline of investment-ready enterprises emerging from accelerators and incubators.

Hosted by ANDE’s Access to Green Finance project in India and TechnoServe India’s Greenr Sustainability Accelerator, in partnership with Mahindra and with support from the IKEA Foundation and VISA Foundation, this event brought together investors, corporates, Enterprise Support Organizations (ESOs), and startups to explore strategies for strengthening ESO programs and making green businesses investment- and market–ready on April 16, 2025, in Mumbai.

The event featured a Corporate Dialogue that highlighted the need for flexible, blended capital approaches—combining equity, debt, and grants—while encouraging a shift from consumer-facing solutions to systems-level innovation. This was followed by an Investor Reverse Pitch, which offered SGBs insights into investor expectations and common red flags, while fostering stronger collaboration among capital providers. Overall, the event underscored the value of patient, strategic capital, and coordinated ecosystem support to scale impactful climate solutions.

From honest insights in the reverse pitch to inspiring founder stories, the day was packed with conversations that matter—and momentum that lasts.

Featured voices:

• Ajay Menon, Program Director, Greenr Sustainability Accelerator

• Rajendra Kamble, Director – Sustainability Consulting, JLL India

• Ankit Todi, Chief Sustainability Officer, Mahindra Group

• Shrikant Deo, Vice President – Innovation, Reliance Innovation Leadership Centre

• Kinkini Roy Choudhary, Managing Director, Accenture

This episode dives deep into how large enterprises can catalyze scale for climate-first Small and Growing Businesses (SGBs)—by showing up not just as investors, but as ecosystem partners.

Featured voices:

• Kinkini Roy Choudhary – Managing Director, Accenture

• Ankit Todi – Chief Sustainability Officer, Mahindra Group

From patient capital and gender-lens investing to founder-first support and ecosystem strategy, here’s what leading voices had to say.

Featured voices:

• Rohan Galla – Spectrum Impact

• Gautam Khot – Managing Partner, 7thGen Ventures

• Hanisha Vaswani – Managing Partner, Majority

• Prakhar Singh – VC, Enzia Ventures

• Rachita Gupta – Peak Sustainability Ventures

• Rajat Kukreja – COO, The Sustainability Mafia

• Ananya Saini – Climate Lead South Asia, ANDE

Climate-focused founders and investors came together to ask: What does it really take to fund and scale climate-first businesses in India?

Featured voices:

• Ajay Menon – Program Director, Greenr Sustainability Accelerator, TechnoServe

• Prakhar Singh – VC, Enzia Ventures

• Rohan Galla – Spectrum Impact

• Rajat Kukreja – COO, The Sustainability Mafia

• Kedar Kulkarni – Director, Biodoc

• Saurabh Agarwal – Founder, GROWiT

Startup founders share their journey, narrating key insights and opportunities gained through the program.

Featured voices:

• Sheikh Ziaur Rahaman – Chief Business Officer, Pavings Plus

• Gaurav Dwivedi – Chief Executive Officer, UGreen Technology

• Shwet Agarwal – Chairman Emeritus, North East Granulators

• Ravindra Joshi – Founder, AmpCycle

• Rajat Kukreja – COO, The Sustainability Mafia

Get Involved:

Ready to make a tangible impact on the future of our planet? While the application for Kenya are already closed, if you’re an investor working in India and are interested in participating in the cohort, you can apply to be part of this transformative initiative.

For further information about ANDE’s Access to Green Finance Project, please contact:

-

India – Ananya Saini (ananya.saini@aspeninstitute.org)

-

Kenya – Francis Gitau (francis.gitau@aspeninstitute.org)