There has been a steady increase in entrepreneurial activity and the Small and Growing Business (SGB) support ecosystem over the past few years across the South Asian region. Though the countries in this region have different nuances, there has always been an underlying current of similarities in the challenges and opportunities the SGB ecosystem across them presents. This regional convening will follow up on the momentum built in the previous three editions around bringing the ecosystem of entrepreneur support organisations together to catalyse cross-border collaboration to accelerate on-ground action towards achieving the SDGs, especially in the changed political scenario globally.

South Asia Convening 2025 is taking place in the context of unprecedented global upheavals, the impacts of which are reverberating across the South Asia region as well. In this context, the main theme of the South Asia convening is: Building Tomorrow’s Ecosystems: Connect, Innovate, Transform.

Insights into strengthening place-based ecosystems – from diagnostics and policy to local collaboration. The recent changes in the global trade and development sector indicate a strong need to strengthen regional ecosystems and increase regional and local collaboration between ecosystem players. We also encourage partners to share their failures and learnings with the broader ecosystem.

Date: 2 December 2025

Time: 11:00 AM – 12:15 PM (IST) | 11:30 AM – 12:45 PM (BST)

SESSION 1: The Green Transition – Financing Sustainable Futures (Anchored & Designed by Accelerate Prosperity – Aga Khan Development Network)

As South Asia faces the dual challenge of economic recovery and climate resilience, this session explores how innovative financing, impact investment, and ecosystem collaboration can enable a just and sustainable green transition. Anchored by Accelerate Prosperity, the discussion brings together diverse voices working at the intersection of sustainability, entrepreneurship, and finance to unpack pathways toward greener, more inclusive economies. This session will present a holistic regional perspective on mobilizing catalytic capital, strengthening green enterprises, and aligning purpose-driven investment with sustainable impact.

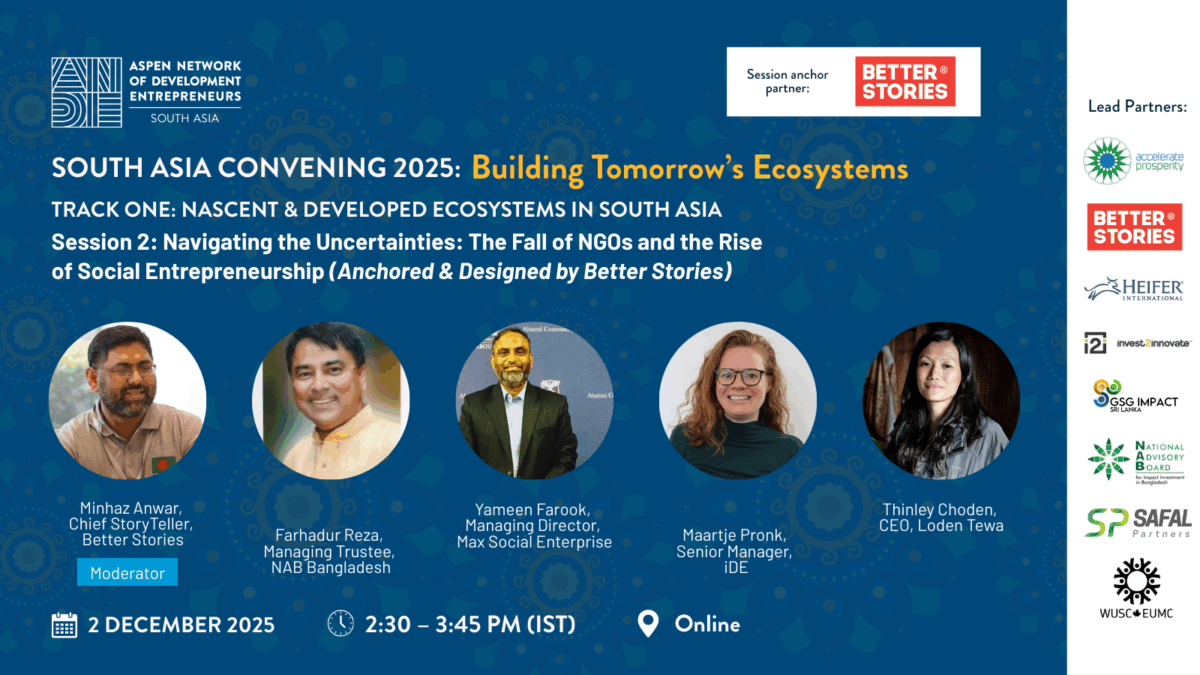

Time: 2:30 – 3:45 PM (IST) | 3:00 – 4:15 PM (BST)

SESSION 2: Navigating the Uncertainties: The Fall of NGOs and the Rise of Social Entrepreneurship (Anchored & designed by Better Stories)

The transition from traditional grant-funded development to market-based solutions is one of the most critical trends in the South Asian development ecosystem. This session seeks to move beyond theoretical debates by hosting a candid, multi-stakeholder discussion centred on an organisational transition: the evolution of Max Foundation Bangladesh.

Their institutional journey—from aid-focused Max Foundation to setting up a spin-off Max Social Enterprise (Max TapWater) —provides the perfect real-world case study for exploring the viability, challenges, and future of social entrepreneurship against the backdrop of shifting NGO funding landscapes. The panel will feature a unique blend of panelists—including the social enterprise MD, a policy-focused investor, and an official donor to ensure that the discussion is grounded in tangible experience, high-level strategy, and crucial funding realities.

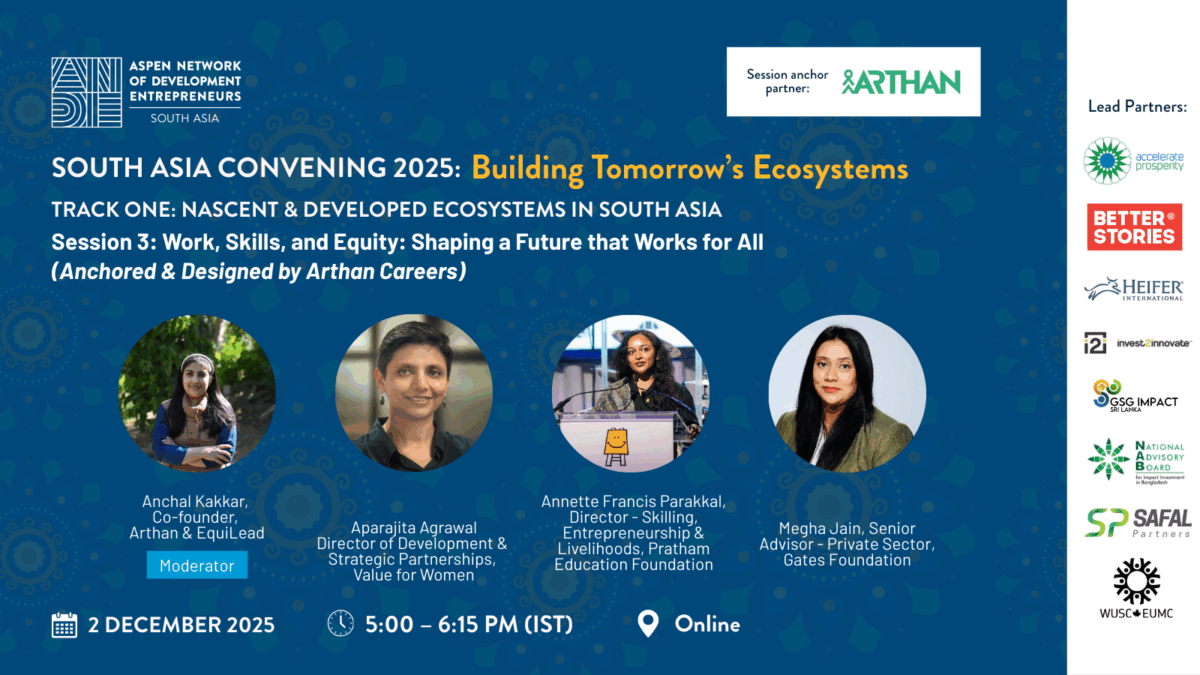

Time: 5:00 – 6:15 PM (IST) | 5:30 – 6:45 PM (BST)

SESSION 3: Work, Skills, and Equity: Shaping a Future that Works for All (Anchored & Designed by Arthan Careers)

As the world of work undergoes rapid change, the demand for new skills and new ways of learning has never been greater. From the rise of AI and automation to the informalisation of jobs, professionals across sectors are navigating uncertainty and change.

This session explores how we can build a future of work that is adaptive, dignified, and inclusive. Bringing together perspectives from across the social impact ecosystem, the discussion will explore the skills, mindsets, and systems needed to help professionals at all stages of their careers thrive in a shifting employment landscape.

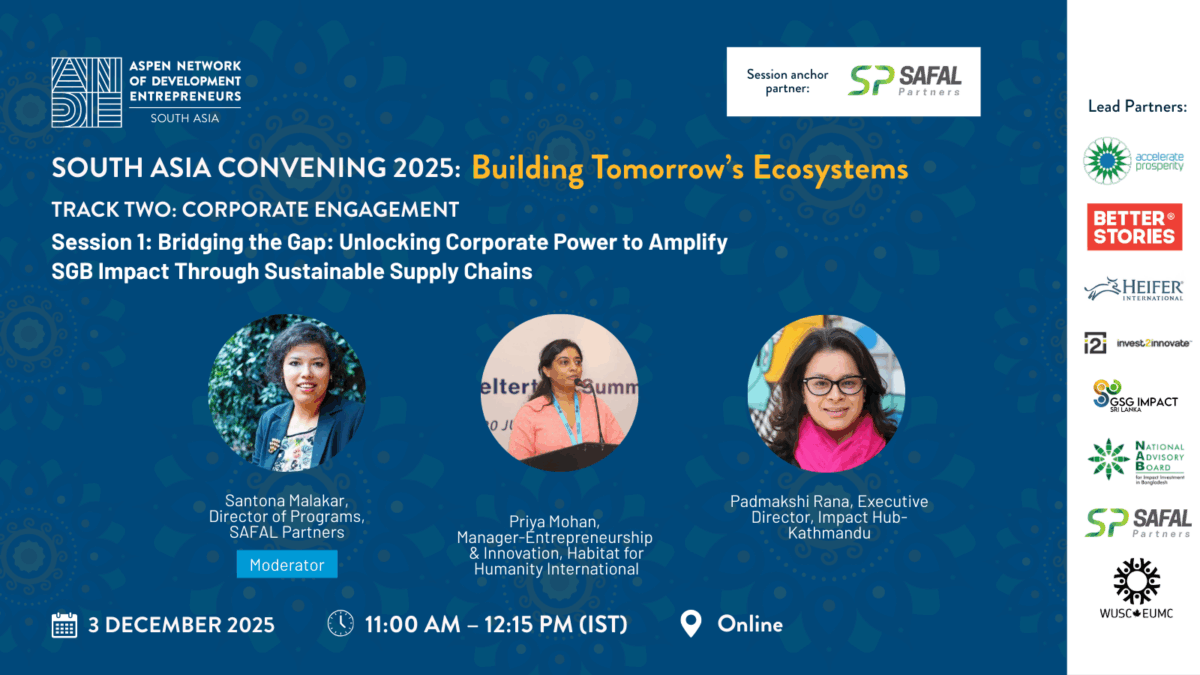

Exploring the growing role of the private sector in supporting SGBs through supply chains, mentorship, procurement, and capital. Globally, corporations have been supporting innovation via multiple modes, and due to public pressure and increased awareness, Environment, Sustainability, and Governance continue to remain relevant.

Date: 3 December 2025

Time: 11:00 AM – 12:15 PM (IST) | 11:30 AM – 12:45 PM (BST)

SESSION 1: Bridging the Gap: Unlocking Corporate Power to Amplify SGB Impact Through Sustainable Supply Chains (Anchored & Designed by SAFAL Partners)

Exploring how the private sector can power small and growing businesses (SGBs) through supply chains, mentorship, procurement, and capital. Join us to discover how corporate engagement is unlocking trillion-dollar opportunities for positive social and environmental impact, bridging the gap between development and business for a sustainable future.

Time: 2:30 – 3:45 PM (IST) | 3:00 – 4:15 PM (BST)

SESSION 2: Inclusive Procurement and the Green Transition – Driving Climate Impact through the Supply Chain (Anchored & Designed by Sattva Consulting)

In the context of inclusive procurement and climate action, this session will explore how businesses in South Asia are advancing the green transition by working with social and environmental enterprises. While large corporations globally commit to decarbonisation, the majority of suppliers and producers in the Global South face systemic inequities, limited financing access, and a disproportionate exposure to climate risk.

This discussion aims to highlight how inclusive and climate smart procurement can simultaneously drive supply chain resilience, emission reduction, and livelihood security, showcasing collaborations that balance social inclusion and environmental sustainability. The session will take a Global South-first lens, spotlighting models from Bangladesh and India where collective action, innovation, and partnerships are driving measurable climate and business outcomes.

From grants and blended finance to catalytic capital and outcome-based funding – what’s working and what’s next. Existing models continue to get refined and new models emerge simultaneously in the funding landscape. This is an opportunity for partners to share innovations and experiences with the broader ecosystem.

Date: 4 December 2025

Time: 11:00 AM – 12:15 PM (IST) | 11:30 AM – 12:45 PM (BST)

SESSION 1: Role of INGOs in Unlocking Impact Investment for Smallholder Farmers and Agribusinesses in Nepal (Anchored & Designed by Heifer International)

This is an invitation-only closed-door session to share insights and foster collaboration among INGOs and development partners on unlocking Impact Investment, focusing on current initiatives, opportunities, and best practices for transforming food system development.

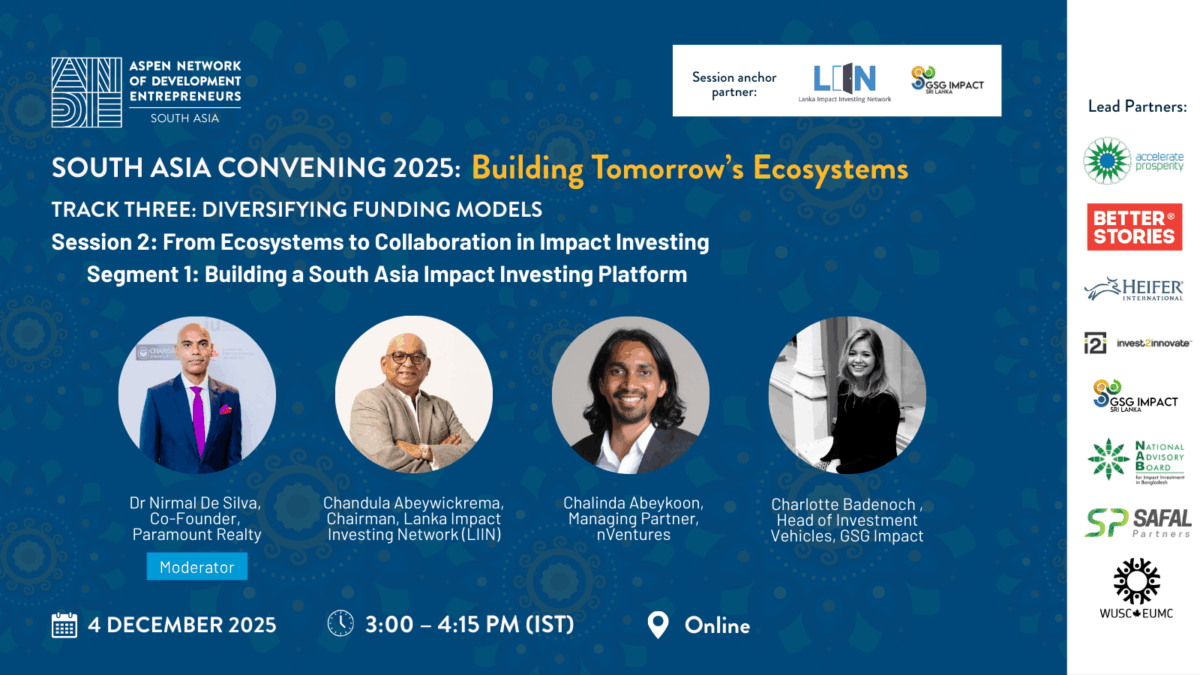

Time: 3:00 – 5:15 PM (IST) | 3:30 – 5:45 PM (BST)

SESSION 2: From Collaboration to Ecosystems in Impact Investing

Time: 3:00 – 4:15 PM (IST) | Segment 1: Building a South Asia Impact Investing Platform (Anchored & Designed by Lanka Impact Investing Network and GSG Impact Sri Lanka)

This session brings together leaders from India, Bangladesh, and Sri Lanka to explore how regional collaboration and diversified funding models can accelerate the flow of impact capital to SMEs across South Asia. The discussion will set the stage for the South Asia Impact Investment Declaration and Fund to be launched at the Lanka Impact Investment Summit 2026.

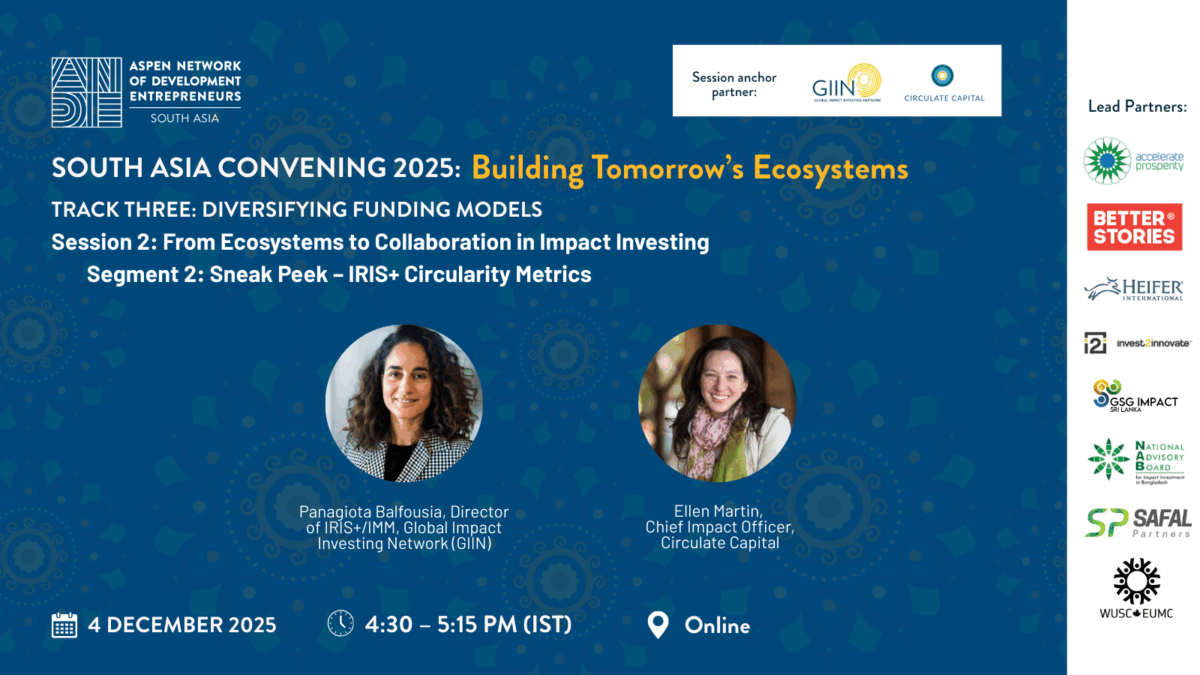

Time: 4:30 – 5:15 PM (IST) | Segment 2: Sneak Peek – IRIS+ Circularity Metrics (Anchored & Designed by Global Impact Investing Network (GIIN) and Circulate Capital)

With 2+ billion tons of waste generated globally each year, the environmental, health and economic stakes continue to rise — but so do the opportunities for meaningful impact, from circular design to strategies that extend and recover product value, to effective waste systems and just, equitable supply chains. This session will discuss efforts to standardize and harmonize impact measurement and management for investors in waste management and circularity. The focus will be on the new IRIS+ impact theme on Waste Management and Circularity that will launch on December 16th.

The IRIS+ Waste Management and Circularity impact theme was developed by the Global Impact Investing Network and supported by the Aspen Network of Development Entrepreneurs. We believe this theme represents a major step forward in helping investors and practitioners measure, manage, and advance impact related to waste reduction, circularity and responsible resource use.

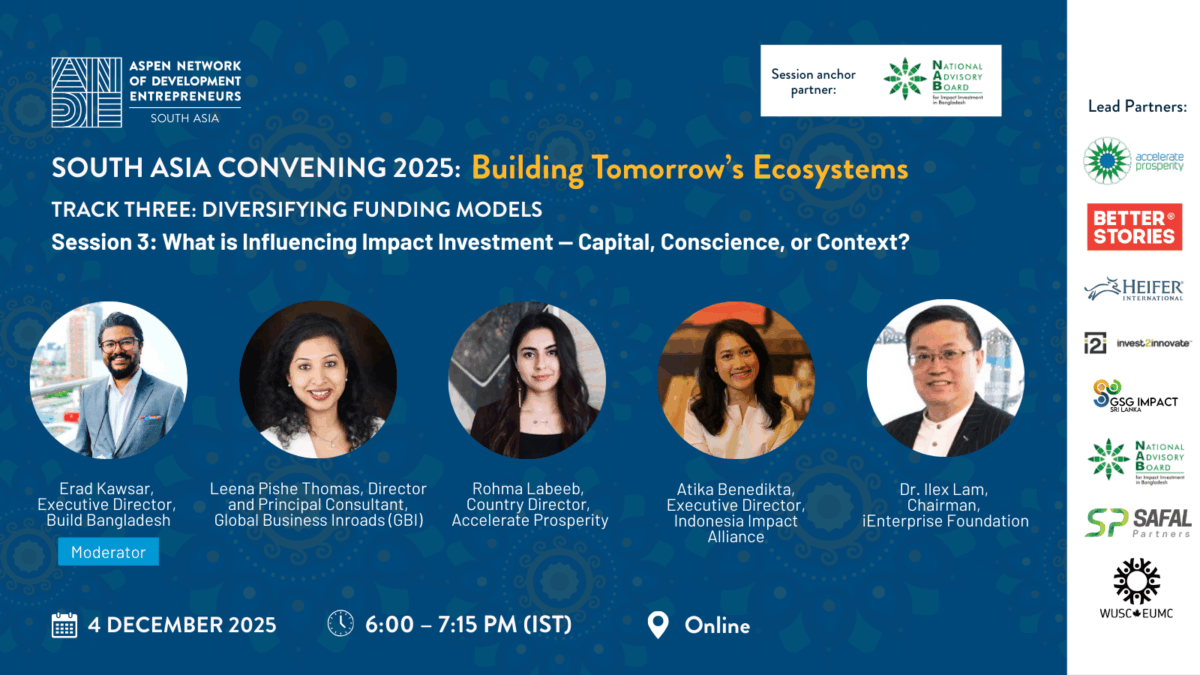

Time: 6:00 – 7:15 PM (IST) | 6:30 – 7:45 PM (BST)

SESSION 3: What is influencing impact investment — capital, conscience, or context? (Anchored & Designed by National Advisory Board (NAB) Bangladesh)

Impact Investment has become one of the defining trends of the 21st-century finance landscape—aligning profit with purpose and driving inclusive growth across South Asia. From blended finance to catalytic philanthropy, diversified funding models are reshaping how capital flows to social and environmental enterprises. But the key question for this year’s ANDE South-Asia Convening is not just how impact investment is influencing funding trends— the core discussion question is:

What is influencing impact investment —capital, conscience, or context?

Global sustainability commitments, evolving investor values, climate imperatives, and new financial instruments are all converging to redefine the DNA of investment. This high-level panel, designed and moderated by NAB Bangladesh, will explore what’s driving these shifts, how diversified funding models can deepen local capital mobilisation, and what it means for the future of sustainable development finance in South Asia.

The convening is open to ANDE members and non-members working to support entrepreneurship in South Asia or looking to expand to South Asia.

We welcome:

- Accelerators, Incubators, and BDS Providers

- Investors and Donors

- NGOs and Development Agencies

- Policymakers and Researchers

- Small and Growing Businesses