FinTechs can address barriers women-led MSMEs face in Latin America, promoting inclusive finance and economic growth through tailored solutions.

Micro, small, and medium-sized enterprises (MSMEs) are the backbone of the Latin American and Caribbean economies, representing 99.5% of businesses, employing 70% of the workforce, and contributing up to 40% of GDP. Despite their critical role, these businesses often struggle to access the financing they need to grow—an issue that is especially pronounced for women-led MSMEs. Pro Mujer’s Gender Knowledge Lab, in collaboration with Acumen Latam Impact Ventures (ALIVE), has released a comprehensive study that sheds light on these challenges and offers actionable solutions for advancing inclusive FinTech practices in the region.

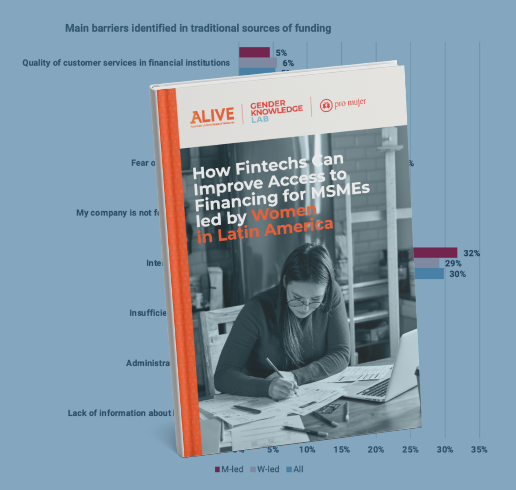

Barriers to Financing for Women-Led MSMEs

The study identifies key barriers within the FinTech ecosystem that disproportionately affect women-led MSMEs, including:

- Limited Access to Credit: One in three SMEs reports credit restrictions, with women-led enterprises facing additional hurdles such as gender biases in lending decisions and lack of collateral.

- Structural Challenges: Women entrepreneurs often operate in industries considered higher risk, further complicating access to funding.

- Digital Gaps: Despite the growth of digital financial services, many women entrepreneurs lack the necessary digital literacy to fully leverage FinTech platforms.

Opportunities for FinTech to Lead Change

The report highlights opportunities for FinTechs to play a transformative role in bridging these gaps:

- Developing Gender-Sensitive Products: Tailoring financial products to meet the specific needs of women-led businesses can help address barriers such as collateral requirements and credit histories.

- Expanding Access to Data: Leveraging alternative data sources can enable more accurate credit assessments, reducing reliance on traditional metrics that often disadvantage women entrepreneurs.

- Investing in Digital Inclusion: Offering training and resources to improve digital literacy can empower women entrepreneurs to utilize FinTech solutions effectively.

Why It Matters

Addressing these challenges isn’t just about equity—it’s also about economic growth. Women-led MSMEs have significant potential to drive innovation, create jobs, and contribute to the GDP. Closing the gender financing gap could unlock billions in economic value, fostering a more inclusive and sustainable future for the region.

Practical Recommendations from the Report

Pro Mujer and ALIVE’s report provides actionable steps for stakeholders, including:

- FinTech Companies: Invest in gender-inclusive design and customer education.

- Policymakers: Create regulatory environments that encourage innovation and protect women entrepreneurs.

- Investors: Prioritize funding for women-focused FinTech solutions and capacity-building initiatives.

FinTechs hold the key to addressing the systemic barriers faced by women-led MSMEs in Latin America. By implementing the report’s recommendations, the ecosystem can pave the way for a more inclusive economy where women entrepreneurs thrive.

Join the conversation on inclusive finance and find practical recommendations for FinTechs, policymakers, and investors to close the gender financing gap.